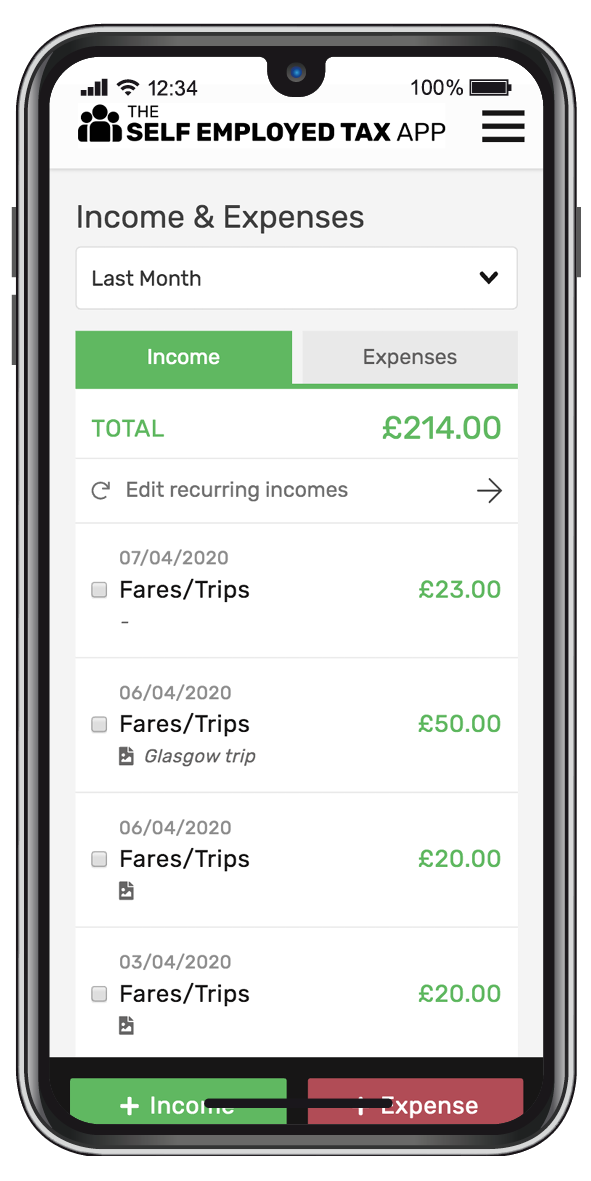

- Simply add your receipts and expenses

- The Self Employed Tax app will produce your tax return

- Hit submit and it gets sent straight to HMRC

- At a glance dashboard

- Compare income streams & previous years’ performances

- Try before you buy with our 30 day free trial

Following the success of The Drivers Tax App over the last 3 years, we’ve now opened the App to include any Self Employed worker.

New HMRC tax rules for the self employed

Making Tax Digital means that you will have to submit four tax returns and a crystallisation statement every year. With four tax returns required a year that’s a lot of accountant fees with the average accountant charging £350 for one return.

The Self Employed Tax App produces and submits a done-for-you tax return for as little as £9.79 per month. You can track your earnings, snap and store receipts, see what you owe in tax and NIC and submit your tax return straight to HMRC.

Save time and money. Get peace of mind. Your tax sorted.

People are diggin’ it

Our pricing

BASIC

£5.79 / month ?If you juin us mid-year, a balancing payment for any unpaid months will be required before you can submit your tax return.

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PRO

£9.79 / month ?If you juin us mid-year, a balancing payment for any unpaid months will be required before you can submit your tax return.

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PREMIUM

£19.79 / month ?If you juin us mid-year, a balancing payment for any unpaid months will be required before you can submit your tax return.

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover (coming soon)

BASIC

£60 / year

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PRO

£100 / year

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover

PREMIUM

£200 / year

Monthly or yearly payment option

View & Submit Tax Return

See your tax liability

Performance Reports

Snap & Store receipts

Discounts & Benefits

Email Support

Telephone Support

Tax Investigation Cover (coming soon)

We’re a web-based app

That means you won’t find us in any app store.

Just go to the website www.thetaxapp.net, and log in.

The benefit is that you can log in from any device, and it won’t use any storage space on your phone.

Got a question?

Email: [email protected]

© 2021 The Self Employed Tax App | Privacy Policy